Original title: Global cereal pesticides market and its product research and development

Source: World Pesticides, Issue 6, 2023

Author: Jiangsu Pesticide Association Pesticide Information Network Bai Yaluo

Cereals are important food crops, including wheat, barley, rye, oats, durum wheat, millet, sorghum, triticale, etc., and are widely cultivated in most temperate regions. Grain is an important application field of pesticides, and it is also an important force to promote the innovation of pesticide products.

The market for cereal pesticides is ahead of corn and rice, ranking first in the pesticide market for food crops. Among them, the market position of herbicides is the most important, accounting for more than half of the country, fungicides have 1/3 of the market share, and the weight of pesticides is low.

In order to solve the new problems that continue to arise in grain production and ensure the healthy growth and bumper harvest of grain, the grain pesticide market has gathered a large number of R&D forces and promoted product iterative upgrading, among which there are many high-profile blockbuster new products.

According to Phillips McDougall's forecast, the global cereal pesticide market is expected to exceed $10 billion in sales by 2024.

Global pesticide market for crops

In 2019, global sales of pesticides used in crops were US$59.827 billion, of which US$15.196 billion (25.4%) was for fruit trees and vegetables ("fruits and vegetables"), US$9.337 billion (15.6%) for soybeans, US$8.969 billion (15.0%) for cereals, US$6.643 billion (11.1%) for maize, and US$6.091 billion (10.2%) for rice (Table 1). From the perspective of food crops, the market for pesticides used in cereals is the largest.

Unlike soybeans and corn, the market for grain pesticides has not been affected by GM technology, and its market volume is relatively stable.

Table 1 Global pesticide market by crop; billion dollars)

Among the world's top 20 crop pesticides, the cereal field herbicide market ranked first except genetically modified seeds, with sales of $4.763 billion in 2019, followed by corn and soybean field herbicides with sales of $4.657 billion and $4.401 billion, respectively. Fungicides and insecticides for cereals ranked 6th and 19th respectively.

Table 2 Top 20 global crop pesticides market in 2019

02

Global cereal pesticides market

In 2019, the global cereal pesticides market had sales of $8.969 billion, accounting for 15.0% of the global crop pesticides market. The compound annual growth rate from 2014 to 2019 is -1.8%; 2014 was at an all-time peak of about $10 billion.

In the cereal pesticide market in 2019, the sales of herbicides, insecticides and fungicides were 4.763 billion, 805 million and 3.008 billion US dollars, respectively, accounting for 53.1%, 9.0% and 33.5% of the cereal pesticide market. Grain field herbicides are the most important in the market, accounting for more than half of the share.

In 2019, 317.6 million hectares of cereals were planted globally. Among them, Russia has the largest planting area, accounting for 12.0%; followed by India 10.9%, China 8.0%, the United States 5.7%, Australia 5.1%, Kazakhstan 4.6%, Canada 4.3%, Turkey 3.4%; Other countries 46.0%.

Due to the importance of commercialization of cereals and the level of financial support, cultivation patterns and yields vary greatly between regions. The EU has strong support for cereal production, with cereal grown widely and cereal yields also high, with an average yield of 5.5 tonnes/ha in 2019.

China's grain pesticide market and grain planting area rank third in the world, but China's grain yield ranks first in the world, and the average grain output in 2019 is comparable to that of the EU, and is also as high as 5.5 tons/ha, far higher than the global average of 3.2 tons/ha.

Table 3 Cereal acreage and production in major cereal growing countries in the world in 2019

From the regional distribution of the cereal pesticide market, Europe dominates, followed by Asia-Pacific, North America, and Latin America.

In 2019, the European cereal pesticides market had sales of $4.174 billion, accounting for 46.5% of the global cereal pesticides market. Four countries, namely Germany, France, Russia, and the United Kingdom, accounted for 61.7% of the cereal pesticide market in the region.

Table 4 European market for pesticides for major cereals, 2019 (US$ billion)

In 2019, the sales of cereal pesticides market in the Asia-Pacific region were $1.927 billion, accounting for 21.5% of the global cereal pesticides market. Compared to Europe, the cereal pesticide market in the Asia-Pacific region is more concentrated, with the leading 4 countries (China, Australia, India, Japan) accounting for 91.1% of the cereal pesticide market in the region.

Table 5 Asia-Pacific major cereal pesticides market in 2019 (USD billion)

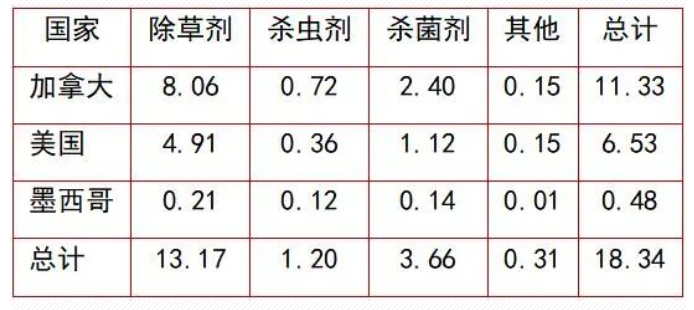

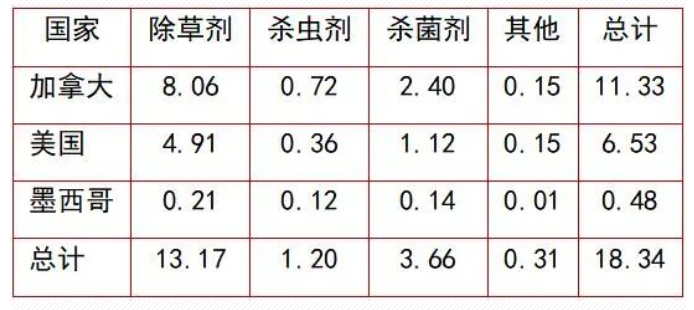

In 2019, the North American cereal pesticides market had sales of $1.834 billion, accounting for 20.4% of the global cereal pesticides market. Among them, Canada has the most prominent market position, accounting for 61.8% of the cereal pesticide market in the region; It is followed by the United States with 35.6%.

Table 6 Major cereal pesticides market in North America in 2019 (USD billion)

In 2019, Latin America had sales of $720 million, accounting for 8.0% of the global cereal pesticides market. Brazil and Argentina are the most important in the market, accounting for 74.9% of the region's cereal pesticides market.

Table 7 Market for pesticides used in major cereals in Latin America in 2019 (USD billion)

Leading products in the pesticides for cereals market

3.1 Leading Products in the Herbicides for Cereal Fields Market

Herbicides are the largest product type in the pesticides for cereals market, accounting for 53.1% of the market in this segment. sales of herbicides for cereal fields were $4,763 million in 2019, growing at a CAGR of 1.6% from 2014-2019.

The top 10 leading products in the grain field herbicides market are, in order, glyphosate, azoxystrobin, metsulfuron, diflusulfuron, 2,4-dichlorodiphenyl, pyraclostrobin, kynurenine, flufenacet, methyl iodosulfuron sodium salt, and metsulfuron methyl in order; and the top 10 leading countries are, in order, Canada, Australia, the U.S., China, Germany, Russia, France, the U.K., India, and Argentina.

In 2019, the Canada Grain Field Herbicides market accounted for $806 million in sales, continuing to rank first globally, with grass weed herbicides dominating the market. In the Canada grain field herbicides market, glyphosate ranked first followed by azoxystrobin; other important herbicides include metsulfuron, thifensulfuron, flutriafol, chlorfluazuron, sulphonylpyrazole, bromoxynil, phenylpyrazine, and others.

With sales of $499 million in 2019, Australia ranked second in the global grain field herbicides market. Glyphosate led the country's cereal field herbicides market, followed by 2,4-drop, fluroxypyr, sulfentrazone, azoxystrobin, diclopyralid, spermaceti, 2-methyl-4-chloro, bendiocarb, paraquat, and others.

The U.S. Cereal Field Herbicides sales amounted to USD 491 million in 2019, ranking third in the global Cereal Field Herbicides market. Its leading herbicides include glyphosate, bromoxynil, dicamba, azoxystrobin, flutriafol, sulfinpyrazole, clopyralid, chlorsulfuron, and others.

3.2 Leading Products in the Pesticides for Cereals Market

In the pesticides for cereals market, fungicides are second only to herbicides.In 2019, global fungicides for cereals sales amounted to USD 3,008 million, accounting for 33.5% of the pesticides for cereals market; with a CAGR of -2.4% from 2014 to 2019.

The top 10 leading products in the fungicides for cereals market are, in order, prothioconazole, tebuconazole, fluconazole, pyrimethanil, flutriafol, propiconazole, fenpyroximate, pyraclostrobin, chlorfluorfenpyrimethamine, and benzoylfenpyrazonazole; and the top 10 leading countries, in order, are, in order, France, Germany, Canada, China, the United Kingdom, Russia, Brazil, Ukraine, Poland, and the United States.

In 2019, Europe Fungicides for Cereals sales amounted to USD 1,912 million, accounting for 63.6% of the global Fungicides for Cereals market. Among them, France, Germany, and the U.K. accounted for $466 million, $375 million, and $200 million in fungicides for grain sales, respectively.

The leading products in the European fungicide market for cereals are similar to the global market; these include methoxyacrylates, succinate dehydrogenase inhibitors (SDHIs), triazoles, morpholino, and other powdery mildew control products, except that the rankings vary considerably between countries.

Canada is the third largest market for fungicides for cereals globally, after France and Germany.In 2019, Canada's fungicides for cereals sales amounted to $240 million. Its market leading products include tebuconazole, chlorothalonil, prothioconazole, propiconazole, pyrimethanil, pyraclostrobin and others.

3.3 Leading Products in the Insecticides for Cereals Market

Insecticides for Cereals market is relatively small compared to herbicides and fungicides.In 2019, the global Insecticides for Cereals sales amounted to USD 805.0 million, accounting for 9.0% of the global Pesticides for Cereals market, growing at a CAGR of -0.2% from 2014 to 2019.

The top 10 leading products in the insecticides for cereals market are, in order, imidacloprid, permethrin, chlorpyrifos, thiamethoxam, chlorpyrifos, cis-cypermethrin, antiflatoxin, oxytetracycline, cypermethrin, and chlorpyrifos; and the top 10 leading countries are, in order, China, Russia, Canada, Ukraine, the U.S., Brazil, Germany, France, India, and Australia.

China is the world's No. 1 market for insecticides for cereals, with sales of $184 million in 2019. The leading products in this market include imidacloprid, oxytetracycline, antiflatoxin, chlorpyrifos, permethrin, and others.

Russia and Canada ranked 2nd and 3rd in the insecticides for cereals market with its sales of $75 million and $72 million in 2019, respectively. The leading products in the Russia insecticides for cereals market are imidacloprid, cypermethrin, cis-cypermethrin, acetamiprid, thiamethoxam, and others, while the leading products in the Canada market are chlorpyrifos, thiamethoxam, chlorpyrifos, chlorpyrifos, cypermethrin, and others.

Research and development of pesticide products for cereals

The cereal pesticides market is rich in products and is a market segment where new and old products are integrated and frequently iterated.

New product development in the cereal pesticide market is relatively active, especially in the herbicide and fungicide fields, which is also consistent with the market position of herbicides and fungicides for cereals.

4.1 Cereal Field Herbicide Product Development

Prior to the 1970s, broad-spectrum products were mainly used in cereal fields for weed control, especially for broadleaf weeds, such as phenoxy herbicides. These products still hold a large market share.In the 1970s, many grass weed herbicides entered the market. Chemical types of herbicides such as ureas (isoproturon, chlorometuron), sulfonylureas (metsulfuron, benzenesulfuron, thifensulfuron), imidazolinones (imidacloprid), aryloxyphenoxypropanoids (kynurenine, oxazoxaflor), and cyclohexylenediones (triclopyr) were marketed to provide a solution to the control of specific weeds.The control of hogweed attracted a lot of R&D input in the 1990s, and control of products were mainly led by clopyralid and acifluorfen.

In 2000, Dow AgroSciences (now Cordova) marketed diflufenzosulfuron; Bayer marketed flutriafol-sulfuron, the first cereal field herbicide based on the chemical structure of triadimefon, which was subsequently divested to Alistair (now UPL). 2001, Aventis (now Bayer) marketed metsulfuron-methyl sodium salt, which had a cross-cutting spectrum of control; Bayer marketed propoxyphenesulfuron; and, in 2002, Aventis marketed In 2002 and 2004, BASF listed flupyrifosulfuron and triflumizuron, and in 2005, LG Chem listed flupyrifosulfuron. 2006, Syngenta listed azoxystrobin, and Dow AgroSciences listed clorazepate. 2007, Bayer listed sulfentrazone, and Dow AgroSciences listed pendimethalin, and 2009, Bayer listed thifensulfuron, a sulfoxaflor sodium salt with cross-control spectrum. In 2009, Bayer listed thifensulfuron with a cross-cutting control spectrum, and in 2011, Combined Chemical listed the grass weed herbicide sulfentrazone.

In 2014, Dow AgroSciences marketed the pyridine herbicide fluroxypyr against broadleaf weeds.In 2016, Syngenta marketed Talinor, a combination of the HPPD inhibitor herbicide fluroxypyr with bromoxynil, in Australia.Dow AgroSciences also marketed a combination of the rice-field herbicide penoxsulam for use in European cereal fields.In 2019, Mitsui Chemicals marketed the phenoxypyridazine herbicide cyclopentazone in Japan. pyridazine herbicide cyclopyrimorate, which mainly controls broadleaf weeds and sedge in cereal and rice fields.In 2021, Fumitsu marketed the isoxaflutole herbicide dichloroisoxaflutole in Australia, which controls annual broadleaf weeds in winter wheat fields. Fumiso is also developing broadleaf weed herbicide F4050 for use in grain, soybean, sunflower and other crop fields. Ishihara Sangyo Co., Ltd. is developing the HPPD inhibitor herbicide SL-1201 for use in cereals, potatoes, soybeans and other crop fields to prevent and eliminate grass weeds and broadleaf weeds. The S-isomer of flubutamate (beflubutamid), beflubutamid-M, developed by UBE Kogyo Co., Ltd. in Japan, is now attributed to Fumitsu, and will be used mainly in cereals for the control of broadleaf weeds. The uracil herbicide eperifenacil developed by Sumitomo Chemical is a PPO inhibitor and will be used mainly in corn, wheat, barley, rice, sorghum and soybeans to control grass weeds and some broadleaf weeds. Fenquinotrione, a novel triketide HPPD inhibitor containing an oxoquinoxaline structure developed by Combined Chemical in Japan, will also be used in rice and grain fields to prevent and control annual weeds.

Following Bayer's sulfentrazone, in recent years, HPPD inhibitor herbicides, which were originally mainly used in corn fields, have entered the cereal field herbicide market more often, becoming a new force in this market and enriching the resistant weed control program in cereal fields.

The following is a brief introduction of some products with large market size or good growth potential.

4.1.1 Azoxystrobin

Azoxystrobin (generic name: pinoxaden; trade name: Axial, Aisu, etc.; development code: NOA 407855) is a phenylpyrazolo-pyrazolo-pyrazolo herbicide developed by Syngenta, which is an inhibitor of Acetyl-Coenzyme A Carboxylase (ACCase), and is now the No.1 selective herbicide for cereal fields in the world.

By inhibiting ACCase activity, azoxystrobin blocks fatty acid biosynthesis and interferes with cell membrane formation, resulting in the cessation of weed growth and eventual death. The chemical structure of azoxystrobin is unique, different from other ACCase inhibitors such as aryloxyphenoxypropanoids and cyclohexenones, and has no cross-resistance, so it is an important tool for wheat fields to cope with resistant weeds.

Azoxystrobin is highly efficient, broad-spectrum, systemic, rapidly absorbed through stems and leaves, and used for post-emergence control of annual grass weeds in wheat and barley fields. In order to improve the safety, it is often compounded with the safener detoxifyl.

Azoxystrobin is suitable for spring cereals, and is highly effective against wild oats, ryegrass, multiflora ryegrass, hardgrass, mistletoe, look-at-meal, Japanese look-at-meal, dogwood, stickleback, etc. in wheat and barley fields, and it is the best agent for the prevention of mistletoe at present. Azoxystrobin is safe for crops, non-target organisms, and the environment.

Barley is sensitive to many herbicides, so there are very few grass weed herbicides registered in barley fields, and only a few varieties of azoxystrobin and spermoxazole are currently available. Tests have shown that the safety of azoxystrobin is very good for both wheat and barley, even at multiples of the recommended dose.

Azoxystrobin is mainly used in cereal and non-agricultural fields, and has been used to a small extent in soybeans, and may be used innovatively in the future in rice, corn and other crop fields.

Launched in 2006, azoxystrobin now covers all major global cereal markets, including the 21 member states of the European Union, the United Kingdom, Canada, the United States, Australia, India, Argentina, China, Russia, New Zealand, Switzerland, Turkey and others.

Since its launch, sales of azoxystrobin have grown at a relatively fast pace, with the market stabilizing in recent years. global sales of $421 million in 2019, representing a CAGR of -0.2% from 2014-2019.

On March 10, 2019, the compound patent (CN1185234C) of azoxystrobin in China has expired.

4.1.2 Sulfentrazone

Sulfentrazone (generic name: pyrasulfotole; trade name: Huskie, etc.; development code: AE 0317309) is a pyrazolone-structured HPPD inhibitor herbicide developed and marketed by Aventis (now Bayer), which initiated the entry of this herbicide class into the cereal market.

Like other HPPD inhibitors, sulfoxaflor pyrazole blocks the conversion of p-hydroxyphenylpyruvic acid to urocanic acid by inhibiting HPPD activity, resulting in the failure of tocopherol and plastoquinone synthesis, affecting carotenoid biosynthesis, and contributing to the development of albinism in plant meristematic and neoplastic tissues, leading to weed death.

Sulfentrazone is mainly used to prevent and control broadleaf weeds in cereal fields, such as quinoa, eggplant, amaranth, abutilon, and flourish, etc. It is applied after seedling. In order to improve the safety of the product, sulfonylpyrazole is often used in combination with the safener pyraclostrobin. The product is also used to control weeds in fallow fields.

In 2007, sulfentrazone was registered and marketed in the United States. Currently, the marketed countries also include Canada, Australia and so on.

The market for sulfentrazone has grown steadily in recent years, with sales of $91 million in 2019 and a CAGR of 8.3% from 2014-2019.

On March 16, 2021, the compound patent (CN1187335C) of sulfentrazone in China has expired.

4.1.3 Flumioxazin

Flumioxazin (generic name: bicyclopyrone; trade name: Acuron, etc.; development code: NOA449280) is a triadimefon herbicide developed and marketed by Syngenta, and is an HPPD inhibitor.

Flumioxazin is slightly toxic, mainly used in corn, grain, sugarcane and other crop fields to prevent and eliminate broadleaf weeds and some grass weeds, with better effect on glyphosate-resistant weeds; pre-planting, pre-emergence and post-emergence applications. To improve safety, the safety agents deslazuron or deslazuron are sometimes added to the product.

In 2015, flufenacet was listed on the market; its market now covers Canada, the United States, Australia, Argentina, Uruguay and other countries; Shandong Weifang Runfeng has obtained export-only registration for three flufenacet products in China.

In 2019, the global sales of Flumioxazinone is 0.70 billion dollars, with a CAGR of 47.0% from 2015 to 2019.

On June 6, 2021, the compound patent (CN1231476C) for flupyrifos in China expired.

4.1.4 Cyclopyrrolidone

Cyclopyrafluazone (generic name: cypyrafluone; trade name: Pucaoke, Huben, etc.) is a new type of HPPD inhibitor herbicide created by Qingdao Qingyuan Nongguan, which opens the precedent of applying this type of herbicides in wheat field to prevent and eliminate grass weeds.

It has a broad spectrum of herbicide, good safety, systemic, and can be used in post-emergence stem and leaf treatments to prevent and eliminate annual grass weeds and some broad-leaved weeds in wheat fields. There is no interactive resistance with the current mainstream pharmaceuticals in wheat fields, and it can be used for the prevention and control of resistant and multi-resistant weeds.

In 2018, Kiyohara AgroGuard registered and marketed its cyclobutrazol product in China; in 2021, cyclobutrazol was approved for registration in Pakistan; and it will be popularized and applied in more countries in the future. Its peak sales are expected to reach $500 million to $700 million.

On May 26, 2034, Qingdao Qingyuan's patent (CN103980202B) for the compound of cyclopyrrolidone applied in China expired.

4.1.5 Bispyribac-sodium

Bipyrazone (common name: bipyrazone; trade name: Snow Tiger, Mai Huan, Snow Eagle, etc.) is also an HPPD inhibitor herbicide independently researched and developed by Qingdao Qingyuan Nongguan, which is a systemic conductive, post-emergence stem and leaf treatment for the prevention and control of annual broadleaf weeds in winter wheat fields. The product is difficult to produce target resistance, no cross-resistance with herbicides commonly used in wheat fields, and has excellent preventive effect against resistant and multi-resistant broadleaf weeds, such as Bushmill, Cow Bushmill, Maijiagong, Artemisia annua, Capsicum annuum, and wild rape.

In 2018, Kiyohara AgroGuard registered and marketed the bispyribac-sodium product in China.

On May 26, 2034, the compound patent (CN103980202B) of diazoxystrobin in China expired.

4.1.6 Quinclorac

Quinclorac (generic name: benquitrione; trademark name: Xianfeng) is a quinazoline diketone structured HPPD inhibitor herbicide discovered by Central China Normal University, developed and marketed by Cinderella, realizing a new breakthrough in the first application of this type of herbicide to sorghum fields for the prevention and control of monocotyledonous weeds.

Quinclorac is systemic, fast-acting and highly safe for sorghum, as well as for corn, sugarcane and wheat. It is absorbed through the stem and leaves to prevent and eliminate annual weeds in sorghum field such as wild millets, matang, barnyard grass, oxalis, dogweed, abutilon, antirrhinum, amaranth, duckweed, celandine and so on, and it is especially effective in preventing and controlling dogweed and wild millets. Its toxicological properties and environmental compatibility are good.

In 2020, Liaoning Senta registered its quinclorac product in China, which will be marketed in 2021; in the future, quinclorac will also be expanded to overseas markets, such as Colombia, Cambodia, Thailand, Vietnam, Indonesia and so on.

On October 24, 2033, the patent (CN104557739B) of quinclorac compound applied in China by Shandong Xianda and Weifang Xianda expired.

4.1.7 Fluorochloropyridine esters

Fluchloropyralid (generic name: halauxifen-methyl; trade names: Arylex, Rejuvenate, etc.; development code: XDE-729) is a hormone herbicide developed by Dow AgroSciences (now Cordyceps) and is the first product in the aryl pyridinium carboxylic acid ester chemotype.

Flucicloprid ester mimics the action of high doses of natural plant growth hormones, causing overstimulation of specific growth hormone-regulated genes and interfering with multiple growth processes in sensitive plants. Flucicloprid ester binds to the receptor in a unique way, which is not only different from the target site of other hormone herbicides, but also has a stronger affinity with the site. Especially the tight binding with AFB5 makes it a significant reduction in dosage, faster weed control, no cross-resistance with other herbicides, and an important tool for the prevention and control of resistant weeds.

Flucicloprid ester is slightly toxic, highly efficient and broad-spectrum, mainly used in cereals, soybeans, brassicas, etc., to prevent and eliminate broad-leaved weeds such as Artemisia annua, Capsicum annuum, Picrorrhizum sativum and other resistant weeds, and it is regarded as an important tool for the prevention of persistent broad-leaved weeds in wheat, barley and other crop fields. To improve safety, fluroxypyr is also used in combination with the safener detoxifyl.

In 2014, fluroxypyr was first registered and marketed in China, and is currently marketed in other countries including Argentina, Australia, Canada, the United States, the 22 member states of the European Union, the United Kingdom, and Brazil, among others.In 2019, global sales of fluroxypyr amounted to $0.45 billion. Cordova expects its peak annual sales to exceed $600.00 million.

On January 11, 2027, Fluorochloropyridine ester's compound patent (CN101360713B) in China expired.

In addition, Cordiva is developing Bexoveld, a third-generation aryl pyridine carboxylic acid ester product, to control broadleaf weeds in cereal fields.

4.1.8 Trifluralin

Triflufenzuron (generic name: trifludimoxazin; trade names: Tirexor, Vulcarus, etc.; development code: BAS 850 H) is a triazinone herbicide developed by BASF. It is a protoporphyrinogen oxidase (PPO) inhibitor, which destroys cell membranes and leads to the death of weeds by inhibiting PPO.

Triflumizone is fast-acting and persistent, with touching effect, rapidly absorbed through roots and leaves. It is used in cereals, corn, soybeans, fruit trees, vegetables, peanuts, and non-agricultural fields, etc., to prevent and eliminate grass weeds and broad-leaved weeds, such as ryegrass, early morning glory, horse marestail, cowslip, traditional witch hazel, pigweed, quinoa, ragweed, anticarpine amaranth, and Indian hemp, etc. The product can also control Amaranthus and broad-leaved weeds, which can be used in the field of herbicide. The product can also prevent and eliminate weeds of Amaranthus and Ragweed which are resistant to PPO inhibitors, and can be used for weed resistance management. It is used before sowing, before seedling and after seedling.

In 2021, trifluralin was launched and is now sold and used in Australia, Canada and the United States, and will be extended to wider markets in the future.

On June 10, 2030, the compound patent (CN102459205B) of triflumizine in China expired.

4.1.9 Dichloroisoxaflutole

Diclofop (generic name: bixlozone; trade name: Isoflex; development code: F9600) is an isoxazolinone herbicide developed by Formica as a deoxy-D-xylulose phosphate synthase (DOXP) inhibitor.

Diclofop is systemic, absorbed by roots and shoots, and conducted through the xylem in the plant. It is suitable for fruit trees, vegetables, rice, barley, wheat, cotton, sugar beet, oilseed rape, etc., preventing and eliminating grass weeds and broadleaf weeds, and is effective against difficult weeds such as ryegrass; it can be applied at the time of sowing or at the early stage of pre-planting and post-planting, and the duration of efficacy can be up to 12 weeks; it can also be used in the management of resistant weeds.

Diclofop was firstly registered in Australia in 2020, and was launched on the market in the following year, and in 2021, Formica registered Diclofop as a crude drug and a single product "Fenxi" in China. "Sequestrong is a soil spray for the control of annual broadleaf weeds in winter wheat fields. Diclofop will mainly target the markets in Europe, the United States, Brazil, and the Asia-Pacific region, and its peak annual sales are expected to reach $250 million.

4.1.10 Cycloheximide

Cyproheptadine (generic name: cinmethylin; trade name: Luximo, Luximax, etc.; development code: BAS 684 H, etc.) is a benzyl ether herbicide, originally developed by Shell, and now under BASF.

Cyproheptadine is a selective inhibitor of fatty acid thioesterase (FAT) of acyl carrier protein (ACP), which inhibits fatty acid biosynthesis and destroys cell membranes, leading to weed death.

Cyproheptadim is a preemergence herbicide, persistent, used in cereal fields, preventing and eliminating many grass weeds, with better activity on resistant weeds and difficult weeds such as big spike look-at-me, ryegrass, etc. The persistence period of ryegrass is up to 12 weeks; it is also used to prevent and eliminate weeds in rice fields, such as barnyard grass, duckweed, heterotypic sedge, etc.

Cyprodinil has been registered and marketed in China, Australia and other countries, after which the market has been silent for more than 10 years. 2019, cyprodinil original drug was re-registered in Australia; in 2020, Luximax (750 g/L cyprodinil emulsifiable concentrate) was registered and marketed in Australia. 2022, cyprodinil was registered in the United Kingdom; and 2024, cyprodinil will be marketed in Indonesia, and will be used in rice. In 2024, cyprodinil will be marketed in Indonesia for use in rice, and will continue to be marketed in other Asian countries. In recent years, BASF has conducted trials in China and plans to return to the Chinese market.

Cyproheptadim is not a new active ingredient, but a new pesticide that is expected to become an important tool in BASF's weed management program for grain and rice fields.

4.1.11 Flumetsulam

Flumetsulam (generic name: tiafenacil; trade names: Terrad'or, Tergeo, etc.; development code: DCC-3825) is a new type of uracil-based non-selective herbicide, a PPO inhibitor, jointly developed by FUAMO HANNON CORPORATION and the Korea Research Institute of Chemical Technology.

Flumetsulam acts by inhibiting protoporphyrinogen oxidase during chlorophyll biosynthesis. Plants usually lose their green color and show necrotic symptoms within a few hours; sensitive weeds die within a few days.

Flumetsulam has touch and defoliation effects, broad spectrum of grass killing, and fast onset of action. It is mainly used in soybean, rape, rice, corn, wheat, cotton, grape, fruit trees, non-agricultural fields, etc. It can be applied before planting, before seedling and after seedling, to prevent and eliminate broad-leaved weeds and grass weeds, such as Abutilon, Amaranthus, barnyardgrass, polygonum curculioides, groundnut, quinoa, wild oats, traditional witchweed, common ragweed, Matang, ryegrass, big dogwood, etc.; it can also prevent and eliminate weeds which are resistant to glyphosate and ALS inhibitors and triazines. It can also prevent weeds resistant to glyphosate, ALS inhibitors, triazines and other herbicides.

As a touch-type herbicide, flumioxazin is mainly located in the market of corn, soybean, wheat and other crops; as a defoliant, the product is mainly used in fruit trees, cotton and other fields.

In 2018, flumioxazin was first marketed in South Korea; it is also currently applied in Sri Lanka, Australia, the United States, Canada, Brazil, and other countries. In addition, the company is also carrying out registrations in China, several South Asian countries, and South American countries.

On September 23, 2029, the patent (CN102203071B) for flumioxazin compounds filed in China by the Korea Institute of Chemical Technology and Dongbu Hi-Tech Co. expired.

4.2 Fungicide Product Development for Cereals

Early cereal disease control was mainly based on the use of inorganic compounds.In the 1940s and 1950s, Dyson products were marketed; in the 1970s, benzimidazole products were marketed.At the end of the 1970s, the 1st generation of triazole fungicides were marketed (triadimefon, biphenyltriadimenol), which quickly replaced the older chemical products due to their excellent efficacy. However, the widespread use of these products led to the emergence and development of resistance, and epidemic diseases could not be completely controlled, especially powdery mildew. the morpholine fungicides (butylmorpholine, etc.) marketed in the 1980s eased the situation; miconazole, marketed in 1980, was effective in controlling stripe blight, which is resistant to benzimidazole fungicides. In the 1980s and early 1990s, the 2nd, 3rd and 4th generation of triazole fungicides were marketed, which enhanced the ability to control diseases.

Subsequently, the most important chemical types of products that entered the fungicide market for cereals were: methoxyacrylate fungicides, which have been marketed since 1996; and acetamiprid, which was marketed in 2003 and drove the rapid development of SDHI fungicides.

Methoxyacrylate fungicides not only have a broad fungicidal spectrum and low dosage, but also have a greening effect and improve grain yield. The successive listing of this class of fungicides are: ethermethrin, pyrimethanil, oximethanil, pidoxystrobin, pyrazole ethermethrin, ethermethrin, fluoxystrobin and so on.

In 2004, Bayer listed a very broad-spectrum azole fungicide prothioconazole; BASF listed benomyl to control grain powdery mildew, blight, etc. In 2005, DuPont (now Cordyceps) listed propoxyquinoline, which is a special product for powdery mildew control, and Certis listed another powdery mildew control product, cyclofluorfen.

Since 2010, new pyraclostrobin amides and other chemically structured SDHI products have entered the cereal fungicide market one after another, marking a further improvement in the level of disease control. 2012, Bayer marketed flumioxazin to control cereal streak and web blotch, etc.; 2012, BASF marketed a very broad-spectrum flutriafolamid; and 2013, Syngenta marketed a benzyl flutriafol to prevent and control the disease caused by chitinobacteria on cereal grains. diseases caused by chitinobacteria on cereals, powdery mildew, etc.; in 2017, DuPont (now Cordova) listed Vessarya (picoxystrobin + benzoylfenpyrazonazole), to control cereal rust, etc.; in 2017, Syngenta listed flutriafolamid hydroxylamine, Miravis Duo (flutriafolamid hydroxylamine + phenyl ether metronidazole), to control cereal mildew, wilt, leaf spot disease, etc. In addition, Syngenta has recently launched SDHI-type fungicide/nematicide triflumizamide with pyridinamide structure, which has multiple effects.

In 2017, Japan's Caoda listed picarbutrazox to control grain downy mildew, blight, diseases caused by Pythium, and so on.

fenpicoxamid, jointly developed by Dow AgroSciences (now Cordova) and Meiji Sekkei Fruit, to control diseases caused by chitinobacteria on cereals, etc.; chlorfluazole, marketed by BASF, to control diseases caused by cereal rusts and chitinobacteria, etc.; F9650, which is being developed by Fumitec, to control diseases caused by cereal blight and chitinobacteria, etc.; and phenylpyrazole, discovered by Sumitomo Chemical and co-developed by BASF and Sumitomo Sumitomo Chemical discovered and BASF and Sumitomo co-developed the phenylpyrazole fungicide metyltetraprole, which is a quinone external inhibitor (QoIs) that controls many diseases on cereals.

Due to the resistance of Chitinobacteria to methoxyacrylate fungicides, there is a continuous drive to use this group of products in the form of formulated products, especially with triazole fungicides, but also with chlorothalonil, manganese zinc diclofenac, and SDHI fungicides, among others. The SDHI fungicide market has been developing rapidly in order to improve the effectiveness against Chlamydosporium and to realize yield increase.

4.2.1 Prothioconazole

Prothioconazole (generic name: prothioconazole; trade name: Proline, Redigo, etc.; development code: JAU 6476, AMS 21619, etc.) is a triazole-thione fungicide developed by Bayer, which is a very successful product in commercial development and has topped the list of Bayer's products for many years, and it is the No.1 product in the fungicide market of cereals.

Prothioconazole is a sterol demethylation inhibitor, with a wide bactericidal spectrum, good systemic effect, long persistence period, and excellent protection, treatment and eradication activity. It is widely used in cereals, soybeans, oilseed rape, cotton, corn, potatoes, peanuts, rice, vegetables, etc., to prevent and control diseases caused by chitinobacteria, fusarium, beaksporum, etc., such as erythromycosis, powdery mildew, rust, stripe blight, gray mold, leaf spot, basal rot and so on. Especially, prothioconazole can efficiently control wheat blast disease and significantly reduce DON toxin. At the same time, it also provides greening and anti-decay effects and improves crop yield. It is safe for crops and can be used in foliar, soil and seed treatments.

The latest EU assessment shows that prothioconazole has no endocrine disrupting effects.

Prothioconazole was first marketed in Germany in 2004 and is now sold in more than 70 countries worldwide, including: 23 EU member states, Brazil, Canada, UK, USA, Australia, Argentina, Ukraine, Russia, Turkey, China, etc. In recent years, prothioconazole has been introduced in the market of the European Union. In recent years, prothioconazole has seen a surge of registered products in China.

Global sales of prothioconazole were $825 million in 2019, growing at a CAGR of -0.5% from 2014-2019.

On November 7, 2015, the compound patents (CN1058712C, CN1060473C) of prothioconazole in China have expired.

4.2.2 Flucytosulfamuron

Fluxapyroxad (generic name: fluxapyroxad; trade name: Xemium, etc.; development code: BAS 700 F) is a pyrazole amide-structured SDHI-type fungicide developed by BASF, and it is a mainstay of the global fungicide market for grains and soybeans.

By interfering with the tricarboxylic acid cycle on the respiratory electron transport chain complex II, flutriafolamid inhibits the function of mitochondria, prevents them from producing energy, inhibits the growth of pathogenic bacteria, and ultimately leads to their death. There is no cross-resistance with triazoles and methoxyacrylate fungicides.

Flumioxazin is systemic, highly efficient, persistent, provides preventive and curative effects, and is resistant to rainfall. It is used in grain, soybean, corn, fruit trees, vegetables, cotton, oilseed rape, sugar beets, peanuts and other nearly 100 kinds of crops and lawns to prevent and control diseases caused by Chitinobacteria, Gray Staphylococcus, Powdery Mildew, Caulispora, Shank Rust, Silky Mildew, Nuclear Cavity Fungus, Streptococcus, etc., which is safe for crops. Foliar spray and seed treatment are available.

In 2012, flutriafolamide was launched; it is now available in most major markets worldwide, including the UK, USA, Canada, Australia, 21 EU member states, Brazil, China, Japan, Argentina and others. In the future, flutriafolamide will be marketed in more than 70 countries and used in more than 100 crops.

Since its launch, sales of fluazifop has climbed; since 2015, it has become the chief product in the SDHI class of fungicides. in 2019, its sales are $491 million, with a CAGR of 12.3% from 2014-2019. BASF forecasts peak annual sales of flutriafolamide to reach €600 million.

On February 14, 2026, the compound patent (CN101115723B) for flutriafolamide expired in China.

4.2.3 Benzofloxacin

Benzoflumizole (generic name: benzovindiflupyr; trade name: Solatenol, etc.; development code: SYN545192) is a pyrazole amide structure of SDHI fungicide discovered by Syngenta, now co-developed by Syngenta and Cordova, etc. and produced by Syngenta.

It is a broad-spectrum, high-efficiency, long-lasting fungicide with systemic conductivity and penetration. It is used in soybeans, grains, corn, cotton, specialty crops, and non-agricultural fields to control many foliar and soil diseases. It has good preventive effect on diseases caused by chitinosporium on wheat, rust, powdery mildew, basal rot, and total erosion. Foliar spray and soil treatment are available.

In 2013, Benzoflumizole was launched and is now available in Brazil, Argentina, the United States, Canada, the 22 member states of the European Union, the United Kingdom, Australia, China, New Zealand and other countries. Syngenta expects its peak annual sales to exceed $500.0 million.

In 2019, the global sales of Benzoflumizole will be $419 million, growing at a CAGR of 64.3% from 2014-2019.

On October 13, 2023, benzoylfumizole's compound patent (CN100448876C) expires in China.

4.2.4 Flucythrinate hydroxylamine

Fluconazole hydroxylamine (generic name: pydiflumetofen; trade name: Adepidyn, McSweets, etc.; development code: SYN545974) is a SDHI fungicide developed and marketed by Syngenta, which possesses pyrazole amide and N-methoxy groups in the molecule at the same time, which endows the product with a wide range of fungicidal spectrum.

Flutriafol hydroxylamide is used in cereals, corn, fruit trees, vegetables, soybeans, peanuts, oilseed rape, non-agricultural fields, etc. It is used to prevent and control diseases caused by Fusarium, Staphylococcus, Streptosporium, and Caulispora, such as erythromycosis, powdery mildew, malignant seedling blight, gray mold, leaf spot disease, target spot disease, reticulation, leaf blight, and bacilliosis, etc., and it also has a plant health effect and improves the yield and quality of the crops. It is mainly used through foliar spraying and also for seed treatment.

Among the current SDHI fungicides, fluazifop-butyl hydroxylamine is the only one that is highly effective in controlling downy mildew and significantly reduces DON toxins.

Launched in 2017, fluazifop-butyl hydroxylamine is now sold in more than 50 countries around the world, including Argentina, New Zealand, the U.S., Canada, South Korea, Australia, China, Japan, and Brazil, controlling more than 30 major diseases on more than 100 crops. In the future, it will expand to more than 70 countries worldwide.

In 2021, global sales of flutriafol hydroxamate amounted to approximately $300 million. Syngenta expects its peak annual sales to exceed $1.00 billion.

On November 30, 2029, the compound patent (CN102239137B) for fluazifop-butyl hydroxylamine expired in China.

4.2.5 Chlorfluorobiphenylpyrimethanil

Chlorofluorobiphenylpyrimethanil (generic name: bixafen; other names: biphenylpyrimethanil; trade name: Aviator Xpro, etc.; development code: BYF 00587, F9650) is a pyrazole amide-structured fungicide of the SDHI class, which was discovered and produced by Bayer, and co-developed by Bayer and Fumitec.

Chlorfluorobiphenyl pyraclostrobin is broad-spectrum, systemic, and has both preventive and curative effects. Foliar sprays are used in cereals, grapes, corn, potatoes, cotton, sunflowers, soybeans, oilseed rape, sugar beets, and non-agricultural fields to prevent and control many diseases caused by ascomycetes, tamarins, and hemipterans. It has excellent preventive effect against wheat leaf blight, rust, yellow spot, etc. and barley leaf spot, web blotch, rust, etc. It can also control diseases resistant to methoxyacrylate fungicides, such as leaf spot caused by Chlamydosporium.

In 2010, Chlorfenapyr was listed on the market and is now available in 21 member states of the European Union, Australia, the United States, Canada, the United Kingdom, Brazil, Argentina and other countries. Weifang Runfeng has obtained export-only registration for three chlorfluorobiphenylpyrimethamine products in China.

In 2019, the global sales of Chlorfluorobiphenylpyrimethamine was $276 million, with a CAGR of 3.3% from 2014 to 2019. The largest application is on cereals. Bayer expects peak annual sales of chlorfluorobiphenylpyrimethamine to reach €300 million.

On February 5, 2023, the compound patent for chlorofluorobiphenylpyrimethamine in China (CN100503577C) has expired.

4.2.6 Trifluoropyridinamine

Trifluralin (generic name: cyclobutrifluram; trade name: Tymirium; development code: A22417) is an SDHI fungicide/nematicide with pyridinamide structure developed by Syngenta. It is broad-spectrum, highly effective and provides long-lasting protection against nematodes and soil-borne diseases. The product not only protects plant roots, but also controls early stage diseases.

With high efficiency and low dosage, triflumizamide is mainly used in corn, cereals, soybeans, rice, vegetables, potatoes, etc., to control root-knot nematodes, short-bodied nematodes, stem nematodes, cyst nematodes, ring nematodes, etc., and has excellent efficacy in preventing fungal diseases caused by Fusarium, such as crown rot of cereals.

In 2020, Syngenta announced the launch of trifluralin (Tymirium) for use on seed or soil. With Tymirium technology, soil-borne diseases and plant-parasitic nematodes can be effectively controlled, soil biodiversity can be conserved, soil health can be promoted, and crop tolerance to biotic and abiotic stresses can be improved, resulting in higher crop yields.

Trifluralin has been approved for registration in El Salvador; in 2021, Syngenta will apply for registration of trifluralin to Brazil, Australia and other countries; in 2022, it will be registered in Argentina, and in 2023, it may be registered in China. In the next few years, triflumizamide will be available in more than 60 countries around the world for more than 100 crops.

According to Phillips McDougall, the annual peak sales of triflumizamide will reach $500 million.

On March 5, 2033, triflupyridine amine's compound patents (CN104203916B, CN106748814B) expired in China.

4.2.7 Isoflucypram

Isoflucypram (trade name: Tiviant, iblon, etc.; development code: BCS-CN88460) is an SDHI fungicide developed by Bayer. The amide bond in the molecule is partially introduced with cyclopropyl group, which gives the product excellent bactericidal activity.

Isoflucypram is broad-spectrum, highly efficient, low dosage and long-lasting. It can effectively control many cereal diseases, such as wheat rust, powdery mildew, leaf blight, barley rust, web blotch, leaf spot, etc.; at the same time, it can prolong the time of grain filling and improve crop yield.

In 2020, isoflucypram was first marketed in New Zealand; the product will also be registered and marketed in a number of other important grain-producing countries.Phillips McDougall expects peak annual sales of $300 million.

4.2.8 Fenpyroximate

Chlorothalonil [Common name: metconazole; Trade name: Caramba 90, etc.; Development code: KNF-S-474 (Wu Yu, Japan), BAS 555 F (BASF), etc.] is a triazole fungicide discovered by Wu Yu Chemical of Japan, developed jointly by Wu Yu Chemical and Shell (now BASF), and produced by Wu Yu Chemical.

Chlorothalonil is an inhibitor of C14 demethylation in ergosterol biosynthesis, which prevents the invasion of pathogen spores into crop tissues by inhibiting mycelial elongation.

Chlorothalonil is broad-spectrum, highly efficient, has good permeability and systemic, and is transmitted to the base and top of the crop, with both excellent protective and therapeutic effects. It is mainly used in cereals, also used in rape, corn, rice, soybeans, potatoes, fruit trees, vegetables, cotton and other crops, to prevent and control rust, powdery mildew, glabrous blight, and diseases caused by Chitinobacteria, Fusarium, Beaksporum, Streptosporium, and Dictyostelium. Foliar spray, seed treatment can be.

Tests have shown that chlorothalonil not only provides stable and excellent preventive effect against wheat blast, but also has good preventive effect against rust and powdery mildew, and at the same time, it can significantly reduce DON toxin. Chlorothalonil also has growth regulation and health effects. It not only promotes flag leaf health, resists premature senescence, and accumulates more photosynthetic products, but also leads to fuller grain filling, thus enhancing grain yield.

It has been found that chlorothalonil has a microeffective polygenic control resistance mechanism, and its resistance development is slow. Fusarium graminearum remained highly susceptible to chlorothalonil in wheat-producing areas of western Canada where it has been used continuously for more than 10 years. Therefore, chlorothalonil can be an important resistance management tool.

In 1993, chlorothalonil was first marketed in Japan, then entered the European and American markets, and has been widely used worldwide. Currently, it is marketed in 21 member states of the European Union, the United States, the United Kingdom, Canada, China, Brazil, Japan, and many other countries.In 2019, its global sales amounted to $171 million, with a CAGR of -2.5% from 2014 to 2019.

4.2.9 Cyprodinil

Cyproconazole (generic name: cyproconazole; trade name: Alto, etc.; development code: SAN 619 F) is a triazole fungicide researched and developed by Sandoz (now Syngenta), and it has been the leading product in the triazole fungicide market for several years.

Epoxiconazole is a sterol demethylation inhibitor, with a broad spectrum of fungicides, systemic, providing protection, treatment and eradication, with a long persistence period, which can be absorbed quickly by the plant and conducted to the top. It is suitable for grains, soybeans, corn, peanuts, rice, rape, cotton, sugar beets, sugarcane, fruit trees, vegetables, lawns, etc. By foliar spraying, it can control diseases caused by chitinospora, beak spore, caecilian spore, column spore, nucleus discus, filamentous spore and helminth spore, such as powdery mildew, rust, stripe blight, holothurian blight, anthracnose, botrytis and so on.

In 1988, cyprodinil was first marketed in France and Switzerland and quickly developed into the market leader in the European cereal market. Now widely used in the world, its market has covered the United States, Australia, Brazil, Argentina, Russia, Ukraine, China, Japan and many other countries; the application of crops are also many, among them, the most important crops are cereals and soybeans.

Although cyprodinil has been withdrawn from the EU market, it has great potential for development in Latin America, the United States, Australia and other markets. In the Chinese market, cyprodinil is mainly used for the control of wheat powdery mildew and rust, and Syngenta's "Licheng" and Jiangsu Zhongqi's "Dongcui" (both 40% cyprodinil suspending agent) are gradually opening up the market.

4.2.10 Chlorfluazuron

Chlorfluorfenozole (generic name: mefentrifluconazole; trade name: Revysol, Sharp collection, etc.; development code: BAS 750F) is a new isopropanol-triazole fungicide developed by BASF, which breaks the situation that there is no new product on the market of triazole fungicides since 2002.

Chlorfluazole is a demethylation inhibitor, and the unique isopropanol structure in the molecule makes its spatial structure flexible and changeable, which can be firmly combined with the target site before and after the mutation to ensure stable disease control and resistance management level, and it is an excellent resistance management tool.

Chlorfluorfenoxazole is broad-spectrum and highly efficient, with the functions of protection, treatment and eradication, good systemic and apical conductivity, and resistance to rainfall, with a long persistence period of up to 21 d. Chlorfluorfenoxazole is widely used in the treatment of diseases of the genus Chlorfluorfenoconazole.

Chlorfluazuron is widely used in field crops such as cereals, rice, soybeans, corn, potatoes and other cash crops such as fruit trees, vegetables, grapes, oilseed rape, cotton and other non-agricultural fields to prevent and control many fungal diseases, including leaf spot, rust, diseases caused by chitinobacteria on wheat, diseases caused by Colletotrichum on barley, rice blight, rice blast, and tassel rot, etc. It is safe for crops, and it can be used as foliar spray or spray on the surface of the plant. It is safe for crops, and can be used as foliar spray and seed treatment.

Chlorfluorfenozole has a very good environmental compatibility, and has been certified by the European Union, the United States, Australia, and other green and safety levels.

In 2018, Chlorfluorfenozole was launched on the market; it is now available in many countries such as South Korea, Colombia, 24 member states of the European Union, the United States, Canada, the United Kingdom, Australia, New Zealand, and China. In the future, it will be widely used in more than 60 crops in more than 50 countries worldwide. Its peak annual sales are expected to exceed €1.00 billion.

On July 11, 2032, the compound patent (CN103649057B) for chlorfluazole expired in China.

4.2.11 Fenpicoxamid

Fenpicoxamid (trade name: Inatreq; development code: XDE-777) is a biologically-derived fungicide jointly developed by Meiji Fruit and Dow AgroSciences (now Cordyceps), and it is the first new pyridine amide fungicide for cereals.

Fenpicoxamid works by inhibiting mitochondrial respiration at the ubiquinone bonding site of fungal complex III Qi. It is non-interactively resistant to existing cereal fungicides and is an important tool for resistance management.

Fenpicoxamid provides long residual control of all important diseases on cereals, such as rust, leaf blight of Chitinospora spp. and others; it is also used for the control of black streak leaf spot of banana, among others.

In 2018, fenpicoxamid was approved for registration in the European Union and is now registered in nine EU member states, including France. fenpicoxamid has also been registered in several Latin American countries (e.g., Guatemala, Ecuador, Colombia, Honduras, etc.); and in New Zealand in 2019. Cordova has also submitted fenpicoxamid registration information to the United States.

4.2.12 Picolinamide

Picolinamide (generic name: florylpicoxamid; trade name: Adavelt; development code: XDE-659) is the second generation of new pyridinamide fungicide developed by Cordyceps after fenpicoxamid, which has the same mechanism of action as fenpicoxamid, but with wider spectrum of control.

Pyridoxamid has preventive effect, and it also has therapeutic effect when used at the early stage of disease occurrence. Its action target site is unique, and no interactive resistance with other fungicides, very suitable for disease resistance management.

Pyridostigmine can be used to control many diseases, including powdery mildew, scab, anthracnose, and diseases caused by Chlamydosporium, Staphylococcus, Streptomyces, and Candida, on more than 30 types of crops such as grains, grapes, fruit trees, and vegetables, and to improve crop yield and quality.

Pyridostigmine was launched in 2023 and is now being promoted in Australia, Canada, and South Korea. Its peak annual sales are expected to reach $225 million.

On December 17, 2035, the compound patent (CN107205405B) for pyridostigmine expired in China.

4.3 Insecticide Product Development for Cereals

In the pesticides for cereals market, insecticides are niche products. in 2019, their market share is less than 1/5 of that of herbicides. pests on cereals are easier to deal with than grasses and diseases, and there are more agents to control them, and there are also a number of new products on the market.

4.3.1 Chlorfenapyr

Chlorfenapyr (generic name: chlorantraniliprole; trade names: Rynaxypyr, Kangkuan, etc.; development code: DPX-E2Y45) is a bis-amide insecticide developed and marketed by DuPont.In 2017, Formica acquired the global rights to chlorfenapyr.

Chlorfenapyr is a fisetin receptor-acting agent that causes insects to excessively release calcium ions stored in smooth muscle and rhabdomyosarcoma cells, leading to weakened muscle regulation in pests and affecting insect behavior, causing them to rapidly stop feeding and die of starvation.

Chlorfenapyr has endosorption and osmotic effect, and conducts to the whole plant through xylem; it mainly acts through gastric toxicity, and also has poisoning effect by touch. It is highly efficient, broad-spectrum, long-lasting, and resistant to rainfall. It can be used in corn, grain, soybean, rice, potato, cotton, pear, sugarcane, grape, and non-agricultural fields, etc. It can prevent and control chewing mouthparts, and it is especially effective against Lepidoptera pests, and it can also prevent and control part of Diptera, Isoptera, and Coleoptera pests, etc. It can be used as a foliar treatment or as an insecticide. It can be used as foliar treatment, seed treatment or soil treatment.

Chlorfenapyr was launched in 2008 and is now sold in more than 100 countries worldwide. Its 2019 sales of $1.750 billion make it the world's No. 1 insecticide, with a CAGR of 3.5% from 2014-2019.In 2024, global sales of chlorpyrifos are expected to exceed $2.00 billion.

On August 12, 2022, Chlorfenapyr's compound patent (CN100391338C) in China has expired.

4.3.2 Bromoflumizamide

Broflanilide [Generic name: broflanilide; Trade names: Teraxxa, Glico (BASF), Tenebenal, Tembe (Mitsui Chemicals), etc.; Development code: MCI-8007, BAS 45006I] is a meso-diamide insecticide discovered by Mitsui Chemicals and jointly developed by BASF and Mitsui Chemicals.

Bromoflumizamide is a γ-aminobutyric acid (GABA)-gated chloride channel allosteric modulator, which inhibits neurotransmission and blocks inhibitory signals in insects, leading to persistent excitation, convulsions, and death. It has no interactive resistance with other insecticides and is an excellent resistance management tool.

Bromophos Flubendiamide has wide insecticidal spectrum, no systemic, with stomach poisoning, touch and penetration effects, good rapidity and persistence, and is resistant to rainfall. It can be used in soybeans, cereals, corn, fruit trees, vegetables, rice, cotton, potatoes, non-agricultural fields, etc. It is highly efficient against Lepidoptera, Coleoptera, thrips pests, etc.; it can be used to prevent and control grain chinch bugs, etc. through seed treatment; it can also be used for the control of sanitary pests.

In 2019, Bromophos flufenacet was launched and is now being promoted for use in Japan, South Korea, Australia, the U.S., Canada, Mexico, and China, with further registrations and launches in the global market, and is expected to reach peak annual sales of $850 million.

On June 29, 2029, Mitsui Chemicals' patent (CN102119143B) for bromophos flubendiamide compounds in China expired.

4.3.3 Bis(propylcyclopentadienyl)

Bispyribac-sodium (generic name: afidopyropen; trade names: Inscalis, INV, etc.; development code: ME5343) is a biologically-derived insecticide jointly developed by Kitasato Research Institute and Meiji Sekkei Pharmaceutical Co., Ltd. in Japan, and co-developed by BASF and Meiji Sekkei.

Bispyribac-sodium is a chordophore inhibitor. By interfering with the regulation of the transient receptor for vanilloid acid (TRPV) channel complex in insects, it causes the loss of coordination to gravity, balance, sound, position, and locomotion, and rapidly stops the pests from feeding and starving them to death. It has no interactive resistance with existing insecticides and can be used for pest resistance management.

Dicyclopyrrolate has strong penetration, no systemic, stomach and touch poisoning, excellent insecticidal effect, long persistence period, and resistance to rainfall; it is recommended to be used in the larval stage for better preventive effect; it can help the health of crops, and improve the yield and quality of crops.

Bispyribac-sodium can be used in cash crops such as fruit trees, vegetables, grapes and ginger, field crops such as cereals, soybeans, cotton and potatoes, as well as in non-agricultural fields, to control many stinging and sucking mouthparts pests such as aphids, woodlice, whiteflies, leafhoppers, mealybugs, mealybugs, and mesquite, etc, and the persistence period of aphids can be up to 21 d. It can be used as a foliar treatment, as well as a seed treatment or a soil treatment.

In 2018, BASF's dipropylene cyclamate was launched. The product is now being promoted in Australia, India, the US, Canada, China and Pakistan. Its peak annual sales are expected to reach $500 million.

Meiji Fruit Manufacturing and Kitasato Research Institute have jointly applied for many patents on bipropyl cyclamate.On May 30, 2026, its compound patent (CN101188937B) in China expired.

4.3.4 Azimidazole amide

Zinpyrazolamide (generic name: dimpropyridaz; trade name: Axalion; development code: BAS 550 I) is a pyrazolamide-structured insecticide containing pyridazine moiety developed by BASF. It is a chordophore modulator, which inhibits the chordophore action and interferes with the pest's hearing, balance, etc., by blocking signaling upstream of the transient receptor for vanillic acid (TRPV) channel, sense of direction, gravity perception, and locomotor ability, etc., so that the poisoned pests lose coordination, are unable to feed, and eventually die.

Research has shown that the target protein of Zinpyrazamide is different from other chordophone regulators such as imidacloprid, pyridinium quinazoline, bipropyl cyclamate, fludioxonil and so on, and its target site has not yet been clarified, and it has no interactive resistance with existing insecticides, which makes it suitable for the integrated pest management.

Zinpyradifacoum has good systemic conductivity, which can make pests stop feeding quickly, thus stopping the spread of diseases, reducing plant nutrient loss, and improving crop yield and quality. It is mainly used in soybeans, grains, fruit trees, vegetables, cotton, potatoes, and non-agricultural fields to prevent and control lepidoptera, coleoptera, diptera, hemiptera, tassel-winged, isoptera, cockroaches, ants, and other pests, and it is especially efficient against aphids, sooty mold, leafhoppers, mesquite, thrips, and other piercing and sucking mouthparts pests.

In 2020-2021, BASF has applied for registration of zinconazole amide in Australia, South Korea, the European Union, Brazil, India, etc. In 2023, the product was first marketed in Australia, and will also be sold in South Korea this year. BASF plans to further promote the zinpyrazamide product in Asia, Europe and South America in the coming years. Its peak annual sales are expected to exceed $100 million.

On September 22, 2029, BASF's patent (CN102224149B) for the zinpyrazamide compound in China expired.

4.3.5 Flometoquin

Flometoquin (trade name: FineSave; development code: ANM-138, ME5915) is a new quinoline insecticide and acaricide jointly developed by Meiji Sekkei and Nippon Chemi-Pharma. It is an inhibitor of membrane protein complex III (cytochrome bc1 complex) in the electron transport chain of insect mitochondria. It acts on the quinone reduction Qi site in the inner mitochondrial membrane and kills pests by inhibiting energy conversion through the inhibition of electron transport and respiration. This product can be used to control pests that are resistant to existing agents and is suitable for pest resistance management.

Flometoquin has poisoning effects of touch and stomach, good quick-acting, long lasting effect, no systemic or permeability. It is mainly used in fruit trees, vegetables, cereals, tea trees, etc. It has high insecticidal activity against small pests, including Thrips, a Coleoptera pest; Tobacco fly and aphids, a Hemiptera pest; Tomato gall midge and Citrus rusty wall louse, a tick pest; Onion leaf miner, a Hymenoptera pest; Small cabbage moth, vegetable greenfly and Tea fine moth, a Lepidoptera pest.

In 2018, flometoquin was first registered and marketed in Japan; it will be promoted and applied in more countries in the future.

On August 2, 2025, the patent (CN1993328B) for flometoquin compounds filed by Meiji Sekkei and Nippon ChemPharm in China expired.

4.3.6 Fenmezoditiaz

Fenmezoditiaz is the third meso-ionic insecticide successfully developed by BASF after Cordova's trifluorophenylpyrimidine and dichlorothiopyrimidine (both are nicotinic acetylcholine receptor inhibitors).

From the patent (CN105121441B) filed by BASF, it is learned that fenmezoditiaz has a very wide insecticidal spectrum, which can be used in grains, corn, soybeans, rice, cotton, potatoes, oil crops, vegetables, sugarcane, grapes, ornamental plants, etc. It can be used to prevent and control Lepidoptera, Coleoptera, Diptera, Tassel-winged insects, Isochordata, cockroaches, Hemiptera, Hymenoptera, Orthoptera, ticks, fleas, and nematodes. , flea orders, nematodes and other pests or nematodes, preferably against piercing-sucking mouthparts pests, especially suitable for controlling Hemiptera and Tassel-winged pests, and also for controlling internal/external parasites of animals.

Pesticide Market Outlook for Cereals

The market for pesticides for cereals is influenced by a number of factors, including acreage, weather conditions, agricultural commodity prices, new pesticide launches and industry regulatory policies.

In the next few years, some major cereal-producing countries may still be due to the adverse effects of weather conditions dragged down the pesticide market, but new products will be launched on the global cereal pesticide market will play a strong role in promoting, especially several existing products facing the ban on the use of the situation, with a new mechanism of action of the product will usher in a better opportunity for growth.

The insecticide market is expected to grow well in the short to medium term, especially in the Asia-Pacific region, where M. grasshopperi has spread from maize to other crops, such as wheat and sorghum in some parts of China, posing a threat to the country's grain production. Only through effective prevention and control of the moth can its impact on grain production be minimized.

In the field of herbicides, the regulatory issues faced by glyphosate have led to a steady increase in the number of countries recommending glyphosate restriction, which may become a major factor affecting the market for herbicides in cereal fields. However, for better weed control in grain fields, farmers are likely to make more use of advanced technologies at higher prices, thereby pushing up the grain field herbicides market.

Moreover, the area under cereal cultivation is expected to increase in countries such as Turkey, Pakistan, and Canada, thereby favoring the growth of the pesticides for cereals market.

Considering multiple factors, Phillips McDougall forecasts that the global pesticides for cereals market will reach $10,096 million in 2024, growing at a CAGR of 2.4% from 2019 to 2024. Of these, sales of herbicides, insecticides, and fungicides will be $5,384 million, $948 million, and $3,343 million, respectively, growing at a CAGR of 2.5%, 3.3%, and 2.1% from 2019-2024.

Pesticides for cereals boasts of being the number one market in food crops, which is a frequent zone of new and old product turnover, and still has the potential to grow in the future, and is an important place for the global pesticide industry to utilize.