▲ Aug 03-04 2023 CMC-China Conference - Free Registration for a limited time

Top 20 domestic pharmaceutical companies' R&D expenses in 2022

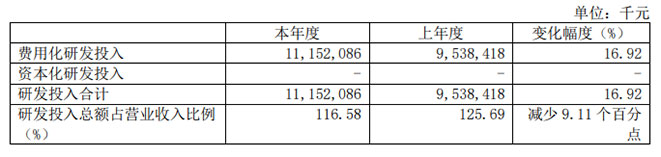

01 Baiji Shenzhou

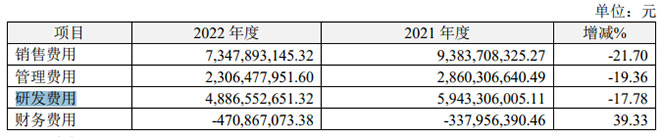

02 Hengrui Medicine

恒瑞医药2022年营收212.75亿元,累计研发投入达到63.46亿元,研发投入占销售收入的比重同比提升至29.83%,创公司历史新高,其中费用化研发投入48.87亿元,较2021同比减少18%。公司已经拥有一支 5000 多人的研发团队,在美国、日本、欧洲和中国多地建有研发中心。2022年恒瑞创新药销售收入为81.16亿元,有近百项创新药学术成果亮相国际顶级学术舞台。

Hengrui Pharmaceutical's revenue in 2022 was 2.2.75 billion yuan, and a total of R & D investment reached 6.346 billion yuan. The proportion of R & D investment accounted for sales revenue to 29.83%year -on -year, and the company has a record high. 18%. The company already has a R & D team of more than 5,000 people to build a R & D center in the United States, Japan, Europe, and China. In 2022, Hengrui Innovation Pharmaceutical's sales revenue was 81.16 billion yuan, and nearly 100 academic achievements in innovative drugs appeared on the top international academic stage.

03 Chinese Biopharmaceutical

Chinese biopharmaceuticals belong to a large pharmaceutical group and have a number of pharmaceutical companies under the jurisdiction. Among them, there are more well -known medical companies such as Zhengda Tianqing, Beijing Ted Pharmaceutical, Lianyungang Runzhong Pharmaceutical and Nanjing Zhengda Tianqing.

In 2022, the total revenue of Chinese biopharmaceuticals was about RMB 28.78 billion, an increase of about 7.1%year -on -year. Among them, the total R & D total expenditure was 4.45 billion yuan, accounting for about 15.5%of the total revenue. Among them, the proportion of R & D investment of innovative drugs and biopharmaceuticals exceeded 74%, and the amount of investment increased by about 19%year -on -year. R & D investment in the field of anti -tumor accounted for about 75%, and the amount of investment increased by more than 15%year -on -year.

Chinese biopharmaceutical focuses on the development of new products in the four major treatment fields of anti -tumor, liver disease, respiratory system and surgery/analgesic. As of the end of 2022, there were 103 products in research, including half (53) of anti -tumor medication. The group has a total of 40 innovative candidate drugs in the field of tumor fields in the clinical application and above development, including 4 products in the listing application stage, 4 products are in the clinical period of clinical III, and 7 products are in the phase of clinical II. The product is in the clinical stage I, and the two products are in the clinical application stage. In addition, the company also has 15 tumor -like biological drugs or generic drug candidates in the clinical application and above development. Chinese biopharmaceuticals are expected to have 8 innovative drugs and 11 biological drugs or generic drugs in the next three years (2023-2025).

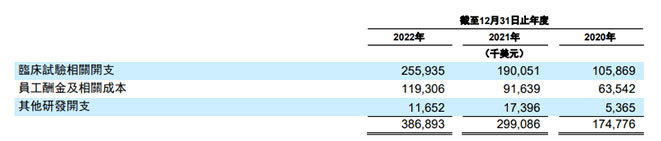

04 and yellow medicine

He Huang Medicine was established in 2000. It has been listed in the three places of the Nasdaq, the London Stock Exchange, and the Hong Kong Stock Exchange. There are more than 5,000 employees, of which about 1,800 tumor/immune business. In 2022, He Huang Medicine released the 2022 performance report, with annual revenue of 426.4 million US dollars, an increase of 20%year -on -year; R & D investment of 387 million US dollars, an increase of 29%year -on -year.

R & D investment is mainly used to expand and innovate tumor candidate drugs. Among them, the US and European international clinical and regulatory affairs teams generated US $ 170.9 million ($ 140.1 million in 2021), and its R & D expenditure in China was US $ 216 million ($ 159 billion in 2021).

The comprehensive revenue of the immune business of Yellow Medicine Tumor is 163.8 million US dollars, an increase of 37%year -on -year. Sutida) and Savatinib (product name: Vorisa). Due to the increase in research and development expenditure of tumor/immunohistos, and then added to the sea, the addition of Paco Vanniti was blocked, and at the end of 2022, he had to make a strategic transformation with Huang Pharmaceutical.

05 Zai Ding Medicine

The total revenue of Zai Ding Pharmaceutical in 2022 was US $ 215 million, an increase of 49.0%year -on -year. However, its R & D expenses are tightening. In 2022, R & D expenditure decreased by 50%year -on -year to 286 million yuan, mainly due to the decrease in authorization fees by 330.7 million US dollars, and the initial and milestone payment of the authorization and cooperation agreement was reduced. From the perspective of project classification, in 2022, the R & D expenditure of clinical projects decreased by US $ 277 million, and the R & D expenses of preclinical projects decreased by $ 4.11 million, and the reduction of the authority was reduced by the reduction in authorization fees.

Four key products in Zaiding Pharmaceuticals in 2022 are: Zhele 145.2 million US dollars (+55.2%), Aipu Shield 47.3 million US dollars (+21.6%), Over $ 15 million (+28.7%), New again Le ($ 5.2 million).

Summarize

Looking at the ranking of domestic pharmaceutical companies' R & D investment in recent years, it is not difficult to see that the top 10 companies have basically maintained the same unchanged. R & D and innovative power enterprises are highly focused, forming a situation where the strong is Hengqiang.

Under the resonance of many factors in policies, technology, capital, and talents, China's innovative drugs have ushered in a booming ten years. In 2022, while the biomedical sector suffered a shock in the capital market, it also ushered in a high -quality innovation opportunity, prompting more than 50 innovative drugs (excluding vaccines) in the Chinese pharmaceutical industry in 2022.

China's R & D expenditure has grown rapidly, but there is still a certain gap compared with multinational pharmaceutical companies. In 2022, global R & D 10 pharmaceutical companies' R & D investment reached 104.32 billion US dollars (equivalent to RMB 722.2 billion); while China R & D investment investment in TOP 10 pharmaceutical companies was only 41.7 billion yuan. Compared with global, existence, existence, existence, existence 17 times gap.

Reference materials: annual reports of each company